Analysis of the market status, competition landscape and development trend of China’s tea and beverage industry in 2020, sugar-free tea will continue to grow in the future

Industry basic overview analysis

Since Rising Sun created the first new concept of "iced tea" in 1993, the Chinese tea beverage market has begun to develop rapidly, and it has now become one of the three major categories. From 2014 to 2019, the size of our country’s tea beverage market increased from 65.30 billion yuan to 78.70 billion yuan, of which sugar-free tea beverages grew rapidly. With the continuous enhancement of consumers’ health concepts, consumers’ demands for tea beverages continue to shift to "healthy", "natural", "sugar-free" and other directions.

Tea drinks, also known as ready-to-drink tea, are mainly divided into four types: pure tea (tea soup), flavored tea drinks, compound (mixed) tea drinks and differential concentrates. In the early 1990s, the advent of Rising Sun Iced Black Tea officially opened the prelude to the Chinese mainland tea beverage market. The successive introduction of iced black tea such as Master Kong and Unification further promoted the rapid development of the black tea beverage category, and also laid the foundation for the entire tea beverage market.

1. Analysis of the industrial chain of the tea beverage industry

The upstream of the tea beverage industry mainly consists of planting and some additives (oxidants, sweeteners, acidity regulators, color protectors, etc.), while tea planting participants are mainly tea farmers and some tea plantations.

After the tea is planted and produced, it is circulated to the midstream deep processing. After extraction, blending, filling and packaging, tea products such as Lipton green tea bags and tea beverage products are produced. Pure tea processing beverages are mainly oolong tea, which is a low-acid beverage. Generally, high pressure sterilization and ultra-high temperature instantaneous sterilization combined with hot filling are used, and hot filling PET bottles and three-piece cans are mainly used.

Flavored tea processing beverages are mostly black tea. The main purpose of such beverages is to add sugar and acid and mix different flavors, so the sweet-acid ratio is extremely important. Flavored tea is an acidic beverage, which adopts pasteurization method, and the packaging types are various, such as two-piece cans, three-piece cans, Tetra Pak bags, etc. Downstream is distributed to consumers through stores, supermarket retail, wholesale or e-commerce.

2. Upstream tea cultivation in China’s tea and beverage industry: China is a global tea powerhouse, with an overall oversupply in the market

Our country is the first country in the world to discover, cultivate and utilize tea, and tea cultivation has a long history. After more than 3,000 years of development, our country has become the largest tea grower in the world, and it is also the country with the fastest growth in tea garden area. However, with the rapid development of tea cultivation, the market is gradually saturated, and it is currently showing a state of oversupply.

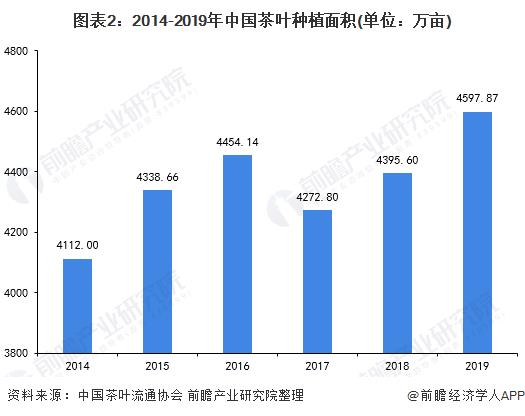

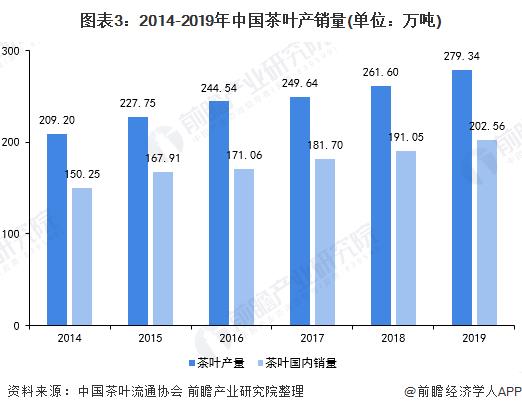

Specifically, from 2014 to 2019, our country’s tea planting area and output showed an overall growth trend. In 2019, the tea planting area reached 45.9787 million mu, and the tea output reached 2.7934 million tons. During the same period, China’s domestic tea sales were 2.0256 million tons and exports were 366,500 tons.

Overall, the domestic market is still the main driving force for the economic growth of China’s tea industry, but at the same time, the pressure of market oversupply is increasing. However, from the perspective of the tea beverage industry, the upstream market supply of the industry is relatively sufficient, which is conducive to the stable operation of the tea beverage industry.

3. The midstream industry of China’s tea and beverage industry: the market scale is developing steadily, and the three giants divide the market

The market is growing.

According to Nielsen’s survey data, as of 2019, the compound growth rate of China’s tea beverage market in the past three years was about 15.2%, making it one of the fastest growing beverage categories. At the same time, during these three years, the number of new products in the ready-to-drink tea market exceeded 100 SKUs each year.

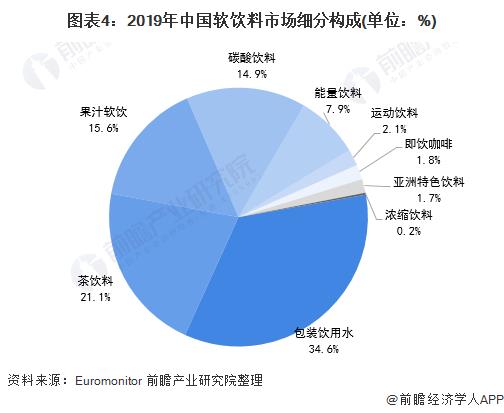

At present, tea drinks have become one of the three major soft drinks, with a 21.1% market share in soft drinks in 2019, ranking second. At the same time, according to Frost & Sullivan statistics, from 2014 to 2019, the size of China’s tea drinks market reached RMB 78.70 billion (excluding herbal tea) in 2019.

2) Sugar-free tea is growing rapidly

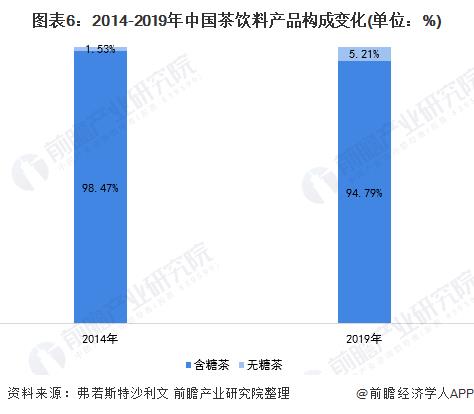

From the perspective of the product category of tea beverages, sugary tea currently occupies the leading position, with a market share of more than 90% in 2019. The base of sugar-free tea beverages is small, but driven by the increased health awareness of consumers, sugar-free tea beverages have grown rapidly, with a proportion of 5.21% in 2019 from 1.53% in 2014.

3) Master Kong, occupy the market uniformly, and Nongfu Spring catches up all the way

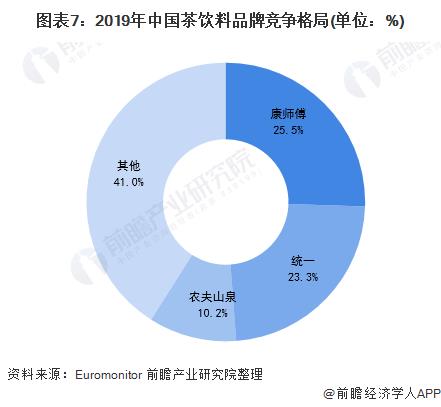

From the perspective of tea beverage brands, after removing herbal tea companies, the traditional tea beverage market is dominated by Master Kong and Unity, with a market share of 25.5% and 23.3% respectively in 2019. Nongfu Spring has occupied 10.2% of the market in recent years with its suddenly popular new tea π, ranking third.

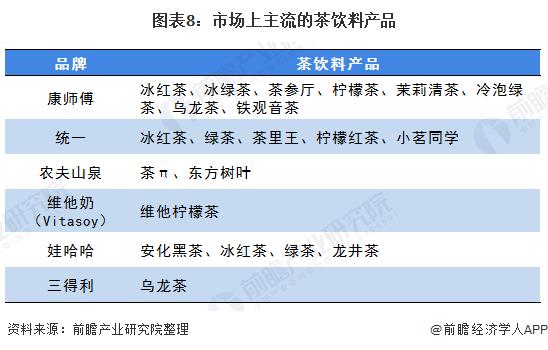

4. Product line: Master Kong’s layout is relatively complete

At present, the tea beverage products on the market mainly include iced black tea, green tea, lemon tea, oolong tea, jasmine tea, etc. From the perspective of product layout, Master Kong and the unified product line are longer, among which Master Kong’s products are more complete; Nongfu Spring mainly has two products: tea π and oriental leaves.

5. Business performance: Master Kong is firmly in the position of "boss"

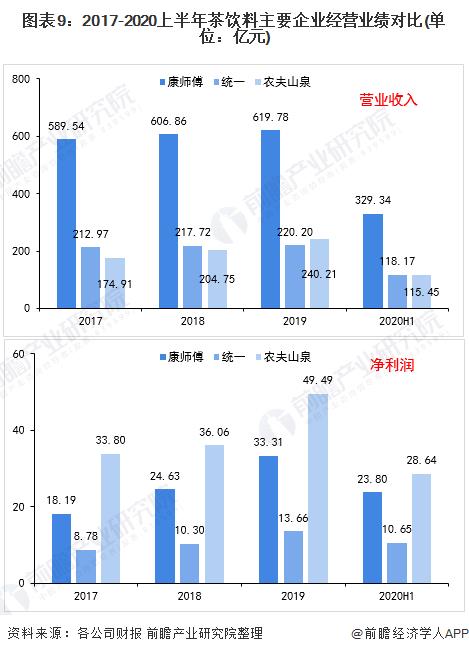

From 2017 to 2019, the operating income and net profit of the three companies showed an upward trend. In 2019, the operating income of Master Kong, Unity and Nongfu Spring was 619.78, 220.2 and 24.021 billion yuan respectively. Master Kang was firmly in the "boss" position, and Nongfu Spring exceeded Unity in 2019.

From the net profit point of view, Nongfu Spring performed well, continuing to exceed Master Kong and Unity, reaching 4.949 billion yuan in 2019, while Master Kong and Unity’s net profit in the same period was 3.331 billion yuan and 1.366 billion yuan respectively. This is mainly due to the layout of Nongfu Spring’s water source, the decline in transportation costs and a reasonable pricing mechanism. In the first half of 2020, the operating income of Master Kong, Unity and Nongfu Spring was 329.34, 118.17 and 11.545 billion yuan respectively.

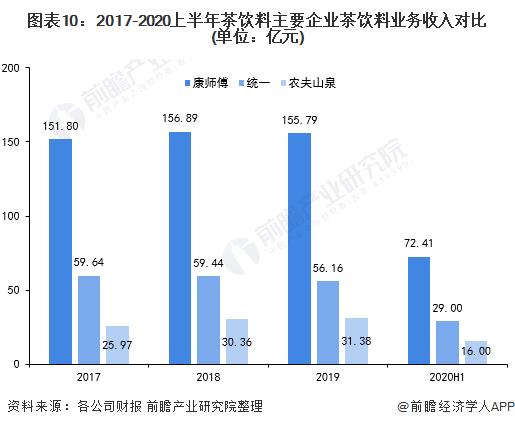

Focusing on the tea beverage business, from 2017 to 2019, the operating income of Master Kong and Unified Tea Beverage fluctuated up and down, and the operating income of Nongfu Spring Tea Beverage showed a significant increase trend. In 2019, the income of Master Kong, Unified and Nongfu Spring Tea Beverage Business was 155.79, 56.16 and 3.138 billion yuan respectively. Except for Nongfu Spring, which increased slightly compared with the previous year, the revenue of Master Kong and Unified declined year-on-year.

Overall, Master Kong’s tea beverage sales revenue is difficult to shake, followed by unification, but the unified tea beverage business income has declined in the past three years, and Nongfu Spring has surpassed unification in terms of total operating income.

In the first half of 2020, the tea beverage business revenue of Master Kong, Unified and Nongfu Spring was 72.41, 29.00 and 1.60 billion yuan respectively, which decreased compared with the same period of the previous year and was greatly impacted by the COVID-19 epidemic.

6. The rise of new tea drinks has seized the tea market

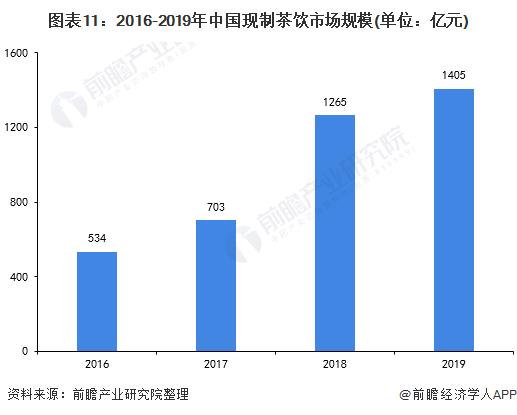

With the upgrading of consumption, a new consumption trend – new tea drinks – has emerged in the tea segment. From 2016 to 2019, the scale of China’s ready-made tea drinks market continued to grow rapidly. In 2019, the size of China’s ready-made tea drinks market (including traditional milk tea, traditional tea drinks, new tea drinks, coffee drinks, other freshly squeezed juices, fresh milk yogurt, etc.) reached 140.50 billion yuan.

According to the "2019 New Tea Consumption White Paper" data, the size of China’s new tea addressable market in 2020 is about 50 billion yuan. While meeting consumers’ demand for drinks, providing consumers with social venues has also become one of the trump cards for offline tea shops to improve their attractiveness. In contrast, bottled drinks in the past are breaking away from the consumption concept of young people.

At the same time, capital has also poured into the new tea track. In March 2020, HEYTEA announced the strategic investment of Coutue and Hillhouse Capital, and the post-money valuation exceeded 16 billion; in June 2020, Nai Xue completed nearly 100 million US dollars of B round financing, and the investor was Shenzhen Venture Capital; in July 2020, Lele Tea received strategic investment.

7. The appeal is shifting to natural and healthy, and sugar-free tea is ushering in spring

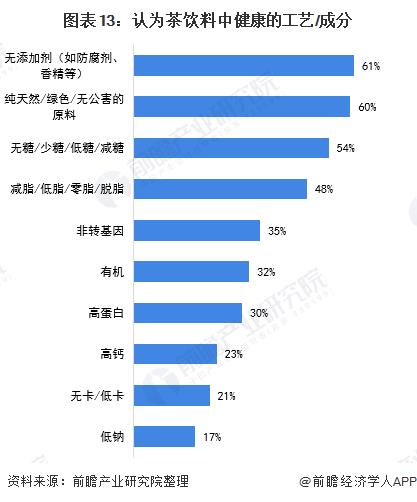

With the continuous improvement of people’s health awareness, the reduction of sugar has become an inevitable trend in the development of the entire beverage industry. According to a survey by Ipsos, tea beverage consumers rank among the top three in the process/ingredients that tea drinks are considered healthy, with no additives (such as preservatives, flavors, etc.), pure natural/green/pollution-free raw materials, no sugar/less sugar/low sugar/reduced sugar.

Although the tea market is still in the "era of iced black tea", that is, most of them are still sweet tea products, more and more low-sugar, sugar-free, and sugar-substitute tea products are becoming more and more popular, and the growth rate of sugar-free tea drinks is generally higher than that of sugar-sweetened beverages.

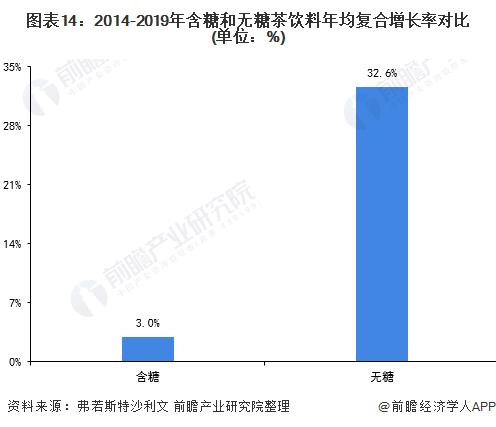

Specifically, the CAGR (compound annual growth rate) of the market size of sugar-free tea beverages in 2014-2019 reached 32.6%, while that of sugar-free tea beverages was only 3.0%. Although the current market size of sugar-free tea beverages is not large, about 4.10 billion yuan, its rapid development momentum has attracted the attention of major manufacturers.

Companies are also following this trend and launching sugar-free tea beverage products one after another. For example, Yinlu’s sugar-free tea drink "Shanyun Tea Painting" focuses on three flavors: Dahongpao, Zhengshan Xiaozong, and Sijichun. Unified’s new sugar-free tea new Tea Pin Tea has also taken a similar route, launching three flavors: Oolong Tea, Jasmine Tea, and Tieguanyin. In the future, this trend will continue, and the market share of sugar-free tea drinks will continue to rise, reaching 12% by 2024.

8. It is expected that the market size will approach 100 billion by 2025

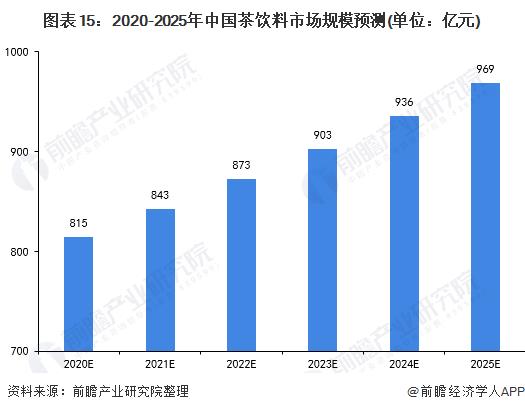

China has a long history of tea culture. The historical accumulation of tea culture and the change of consumption concepts have made many people have accepted tea beverages, indicating that China has a good foundation for tea beverage consumption. The development time of Chinese tea beverages is very short, and the market development is concentrated in large and medium-sized cities. The development of small cities and rural markets is still in its infancy, and the future development prospects are broad.

It is expected that the market size of our country’s tea beverage industry will grow at a compound annual growth rate of 3.5% in the next few years, and the scale will approach 100 billion yuan by 2025.

For more research and analysis of this industry, please refer to the "China Soft Beverage Industry Production and Marketing Demand and Investment Forecast Analysis Report" by the Prospective Industry Research Institute. At the same time, the Prospective Industry Research Institute provides solutions such as industrial big data, industrial planning, industrial declaration, industrial park planning, industrial investment attraction, and IPO fundraising research.