Keep, a sports supermarket disguised as a gym.

Wen | director

Edited by Shi Can

Nearly a year and a half after the first submission of the prospectus on the Hong Kong Stock Exchange, Keep, which updated the prospectus three times, finally settled the date of listing and trading-July 12, 2023, with the offering price range of HK$ 28.92-61.46 per share, which put an end to this slightly "long" IPO journey.

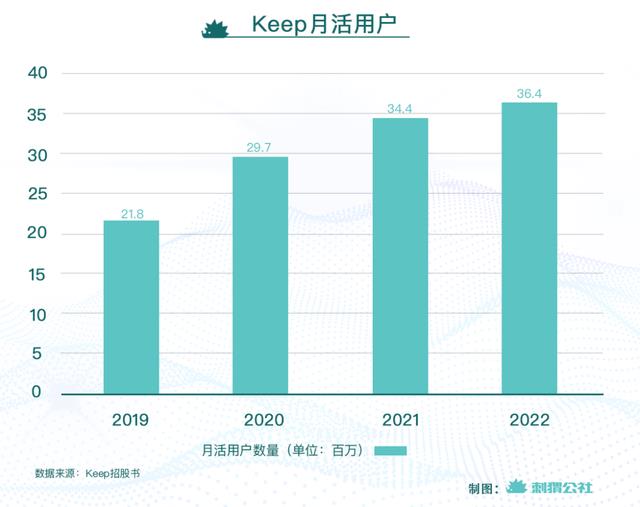

As early as February 2022, Keep submitted a prospectus to the Hong Kong Stock Exchange. Compared with those offline gyms with complete facilities and enthusiastic coaches, in those three years, a unique advantage of Keep-not running-became the reason why many people chose Keep. Compared with e-commerce, social networking and gaming peers facing bottlenecks in growth, Keep’s monthly users increased from 21.8 million at the end of 2019 to 36.4 million at the end of 2022, an increase of more than 60% in three years.

In addition, although fitness is a "anti-human" drudgery, choosing to install Keep on your mobile phone or buy some Keep’s self-operated products in the mall can still bring people a sense of spiritual satisfaction-although I haven’t moved, as long as Keep is by my side, occasionally open the App and take away the clothes piled up on the spinning bike, it is equivalent to me being a regular online fitness person.

Keep’s listing also marks the track of online fitness, and finally ran out of a successful IPO company; Countless users who use Keep "mental fitness" have brought this fitness track unicorn to the temple of IPO. By 2023, when people can freely enter and leave public places such as gyms and sports fields, how long and how far can Keep "Keep" after listing?

Keep, a sports supermarket disguised as a gym.

With the help of Keep’s prospectus, which has been updated many times in the last year and a half, it is not difficult to find that despite fluctuations in various business segments of Keep, the main business is still its own brand sports products-those spinning bikes with the Keep logo, yoga clothes, fitness food, and even small things such as skipping ropes and bracelets.

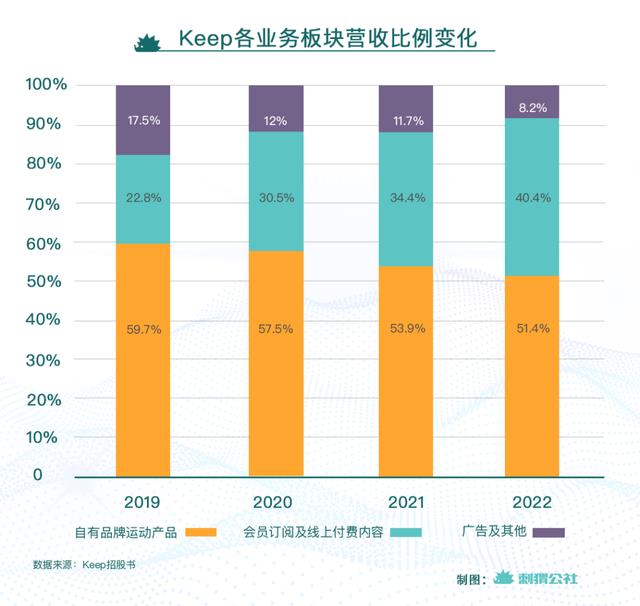

From 2019 to the end of 2022, the overall proportion of Keep’s own brand sports products has been declining, from nearly 60% to slightly over 50%, but in the three business segments of Keep, its proportion is still the largest, contributing half of Keep’s revenue.

Keep’s second largest business is membership subscription and online paid content, that is, the revenue from Keep members and various courses. In the past three years, this part of the revenue contribution has increased the most, from 20% at the end of 2019 to over 40% at the end of 2022, almost doubling.

As for the advertising and other businesses in the third largest revenue segment, the proportion of revenue contributed to Keep is getting smaller and smaller, especially in the past three years, which are all around 10%.

If you think of Keep as an offline gym, such as Leke, its essence is easy to understand:

A gym has various coaches and facilities-corresponding to the various tools and courses of Keep. If you want to take classes and practice, you have to pay, sell classes and apply for membership. In the gym training, you may use various fitness equipment. The most convenient way is to buy it in the sports supermarket that is matched with the gym. Corresponding to the e-commerce service provided by Keep, you can purchase the self-operated products of Keep by placing an order on the third-party platform such as Keep platform or JD.COM.

Generally speaking, the main business of a gym is to sell classes, members, fitness equipment, fitness food, etc. It is only a supporting service, and it will not be the main business of a gym. But Keep is different. It is very different from the offline gym in that it does not make money by selling classes and members, but by selling surrounding areas and fitness products.

Therefore, from this perspective, it is quite accurate to say that Keep is a sports supermarket disguised as a gym. It is an App with content and tools, and it is also an e-commerce company. Compared with selling classes and members, the status of "selling goods" is more important.

Some high-margin commodities

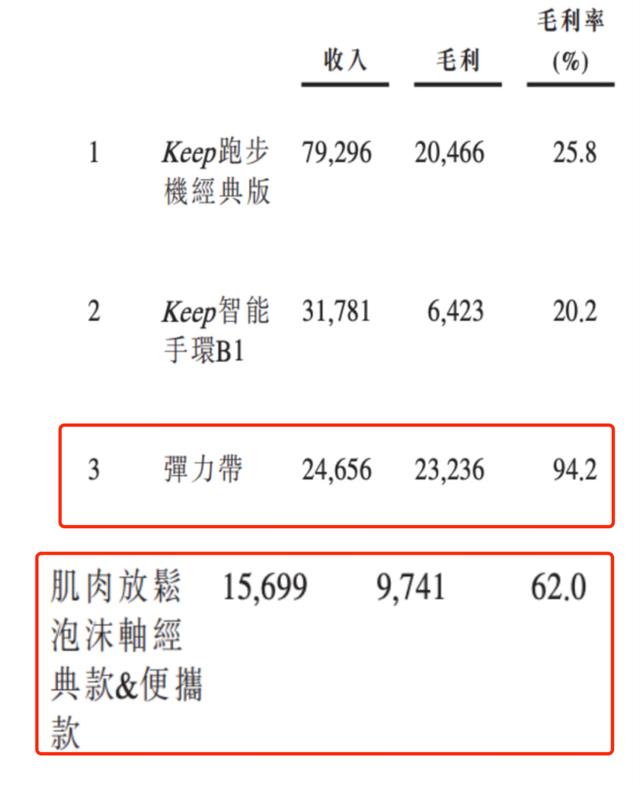

Hedgehog commune (ID: ciweigongshe) found that the gross profit of many Keep self-operated goods is above 60% when consulting the Keep prospectus, and it ranks in the forefront of the sales list. And "counter-common sense" is that what can be called "huge profits" are not intelligent hardware such as spinning bikes and bracelets that look "high-tech", but basic tools such as elastic belt and muscle relaxation foam shafts.

However, the purity of Keep as an "online gym" is also increasing. In the past three years, the income of members and content has doubled, and the proportion of revenue contribution is only 10% lower than that of e-commerce, which is enough to show that Keep still wants to do content seriously and keep "duty". Let users move.

But this process is still anti-human. After all, letting users buy it can provide users with the pleasure of "I am moving" although it costs users money. It is another matter to really use content and members to push users to move.

User: Not if you don’t move, not if you love sports too much.

In the prospectus, Keep disclosed a set of figures that members were slightly embarrassed-in 2019, 2020, 2021 and 2022, the average monthly exercise times of each monthly active user were 4.3, 5.0, 4.1 and 4.8 respectively. From this result, all Keep users have the responsibility to:

Self-discipline gives me freedom, but you only exercise four times a month.

For subscribers who have spent money, this figure is slightly better. The average monthly exercise times of each subscriber are 13.5 times, 10.9 times, 7.2 times and 7.8 times respectively, but it still does not exceed the average level by much, and it shows a relative downward trend. It can be seen that there are many users who "have a gym membership equals fitness", whether online or offline.

For some gyms that are ready to run at any time, it is a good thing that users don’t come often after completing their cards. However, for online fitness apps that rely on user traffic to drive e-commerce business and advertising business, how to attract users has become an important topic.

Hedgehog Commune concluded that Keep wants users to move, mainly by content. For example, introducing fitness experts to settle in, attracting users to practice, expanding the categories of fitness content, and increasing the selectivity of users. The experts in this respect mainly include Pamela, Saturday Wild, Ouyang Chunxiao and so on.

This is similar to the mode of asking coaches to "sell classes" in offline gyms. If their own resources are not enough, they should also introduce new part-time coaches from outside, thus enriching the selection range of members. By the end of 2022, there were 17,800 courses produced by Daren and others, which was more than twice that of the end of last year.

The recent Keep prospectus also mentioned the influence of AIGC on fitness courses. Some basic structured courses and fitness training plans can be completed through AIGC, which is very conducive to improving the efficiency of content production.

Secondly, it depends on the interaction between hardware and users. For example, Keep bracelets, treadmills, spinning bikes and other hardware can interact with users. Among them, users wearing Keep bracelets can synchronize relevant sports data in real time and compete and rank with other users who also participate in live classes. Introducing game-like gameplay, Keep tries to let users stay here; Add "story running" to the running scene, and let users substitute into well-known IP environments such as Empresses in the Palace, so as to help users reduce the boredom of sports with immersive interactive experience.

Source: Little Red Book

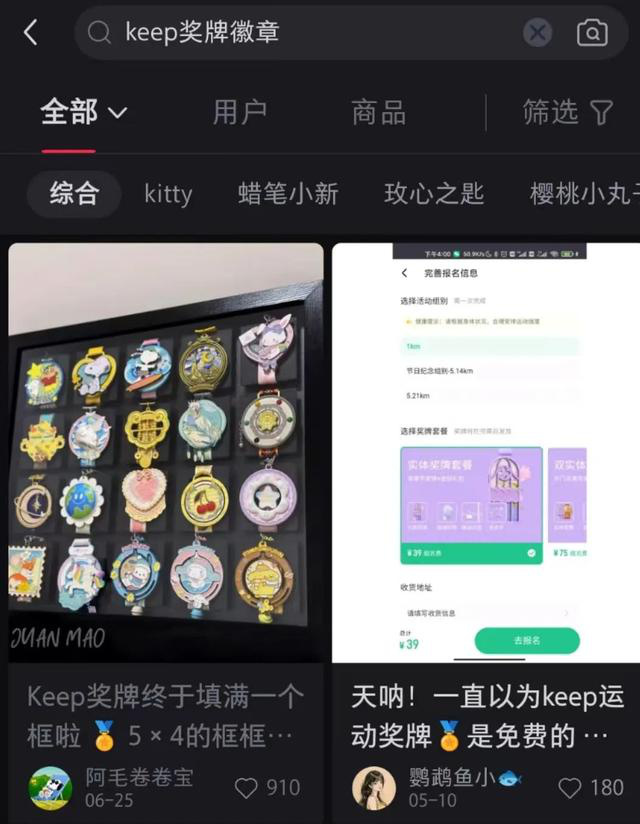

In addition, Keep has also become a tide play company to some extent. Look at the popular "Keep medals" on little red books and idle fish. In order to encourage users to run, Keep has designed a series of exquisite medals, and only users who have run enough are eligible to buy them. This collection of hand-held gameplay is also part of Keep’s efforts to retain users.

Another dilemma for Keep is that users can’t do it if they don’t like sports, and they can’t do it if they love sports too much. They will choose to go out of Keep and exercise in a broader and more interactive sports ground and gym.

In this regard, Keep launched Keepland, an offline gym, in an attempt to form a closed loop. Fortunately, Keep is still in the stage of promoting users to fall in love with sports.

How to prevent from repeating Peloton’s mistakes?

Keep has been trying to impress people with the China version of Peloton for a long time before submitting the prospectus. This is an American online fitness company, which will explode around 2020 with the model of spinning hardware+courses. During the period when fitness demand shifted to online, Peloton not only sold well, but also was widely loved by the capital market, and its stock market value once exceeded $50 billion.

However, with the decline of online fitness demand, Peloton’s performance has fallen sharply, and in 2022, it was greatly laid off, and its market value evaporated by nearly 90%. Today’s Keep, although similar to Peloton, the victim of online fitness ebb tide, will never compare Peloton again.

How to avoid the old path of Peloton is the problem that Keep needs to face.

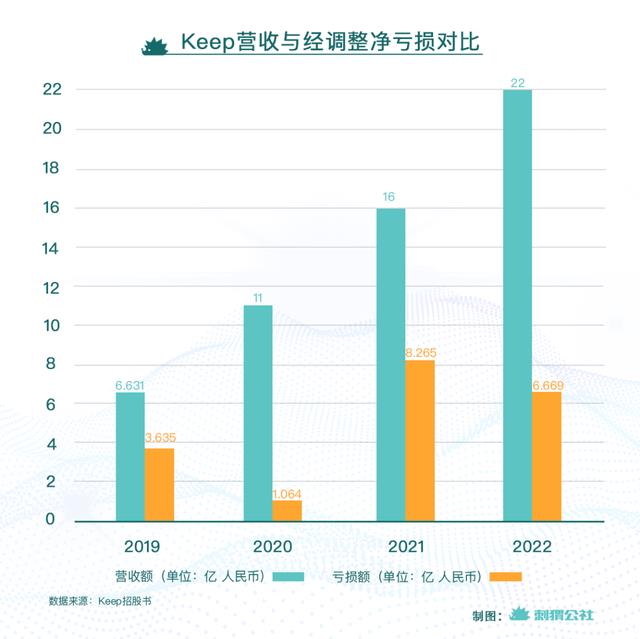

According to Hedgehog Commune, the first thing Keep needs to do is to build itself into a profitable company. Since the end of 2019, Keep’s revenue has increased from 660 million to 2.2 billion, but they are all in a state of net loss. The annual adjusted net loss has reached several hundred million, reaching 666.9 million by the end of 2022, and there is no obvious narrowing in general.

Therefore, it is very important for Keep to "turn losses around" as soon as possible and maintain good hematopoietic capacity after the high tide of online fitness ebbs.

Secondly, Keep also needs to continue to improve the penetration rate of members and speed up the transformation of free users into member users, so that it is possible to keep the basic disk of users and prepare for the subsequent conversion of members’ fees. Keep has done a good job in the past few years, from 3.5% at the end of 2019 to 10% at the end of 2022.

In this regard, content and membership are inseparable. For example, Keep’s interactive live class can only be watched by member users. This "soliciting" method is somewhat similar to the long video platform. It is necessary to continuously enhance the content ability and attract member users to pay for more and better live classes and other high-quality content.

Another revelation given by Peloton is that its user base is always limited only by one kind of hardware and one kind of content. It is impossible for a gym to only have a treadmill. Similarly, an online fitness platform cannot only provide spinning or aerobics.

Coincidentally, similar to Peloton’s great defeat, Liu Genghong, the master of aerobics in the fire in 2022, lost his influence in 2023. This is due to the times, but it can be found that only by operating all kinds of fitness categories and recruiting all kinds of fitness content experts can Keep survive better.

In September 2019, Peloton went public for a week and its market value evaporated by nearly $1.8 billion. Now, when Keep finally stands on the node on the eve of listing, although there is no chance of a big online traffic explosion, it is completely possible to cross the river by touching Peloton.