Federal Reserve Minutes "Sword Finger" cut interest rates in September, and US stocks collectively closed higher in NVIDIA’s official announcement of AI NPC’s first show.

On Wednesday (August 21st), Eastern Time, the Federal Reserve released the minutes of its monetary policy meeting in July, which strongly suggested that interest rates would be cut in September. In addition, the employment growth in the United States suffered the largest downward revision in 15 years, and the expectation of interest rate cuts was once again stabilized, which boosted the US stock market. The three major indexes collectively closed up, but the increase was limited. Obviously, investors were restrained before Powell’s speech.

[US stock index]

Specifically, Fed officials were strongly inclined to cut interest rates at the policy meeting in September last month, and several of them were even willing to cut interest rates immediately (that is, at the July meeting). Almost all officials agree that if the economic data continues to meet expectations, it may be appropriate to relax the policy at the next meeting.

The implication is that if there is no big surprise in the economic data before the September meeting, the interest rate cut in September has basically been nailed.

It is worth mentioning that just one data was significantly revised overnight. In the United States, the number of employed people in the past year to March was initially revised down to 818,000, the deepest in 15 years. After the data was released, the market bet on a sharp interest rate cut of 50 basis points in September rose from 29% to nearly 39%. The employment growth rate is not as strong as originally reported, which may affect the tone of Federal Reserve Chairman Powell’s speech at the annual meeting of global central banks in Jackson Hole this Friday. Some people think that he will not rule out that he will hint at a sharp interest rate cut of 50 basis points in September.

Jamie Cox, an analyst at Harris Financial Group, said: "The minutes of the Fed meeting eliminated all doubts about the interest rate cut in September. The Fed’s communication strategy is to make its meetings less like an event that affects the market, and they strictly follow the script. "

OliverPursche, senior vice president of Wealthspire Advisors, commented: "Market participants are waiting for the results of the annual meeting of Jackson Hole Central Bank. Bulls and bears are waiting to see, and there is no convincing reason to do anything now."

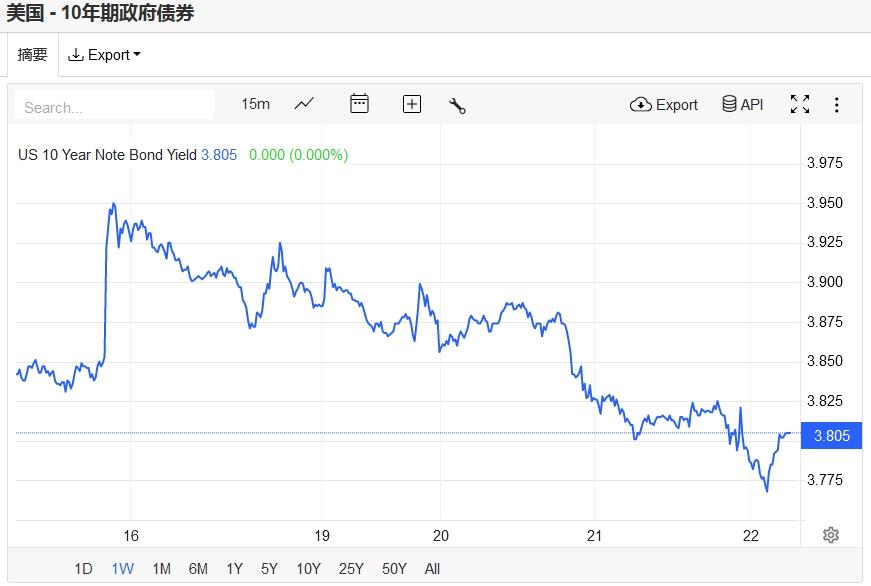

American debt

The yield of US bonds continued to decline, and the benchmark 10-year US bond yield closed at 3.805%. The yield of two-year US bonds, which is more sensitive to monetary policy, finally closed at 3.943%.

[Hot American stocks]

Among the popular US stocks, Apple fell 0.05%, NVIDIA rose 0.98%, Microsoft fell 0.16%, Google C fell 0.79%, Google A fell 0.80%, Amazon rose 0.69%, Meta rose 1.60%, TSMC fell 0.36%, Tesla rose 0.98% and AMD rose 0.90%.

On the important news, NVIDIA recently announced in official website’s technical blog that it released the first device-side small language model (SLM) at the 2024 Gamescom 2024, which can be used to improve the dialogue ability of game characters.

[global index]

In the European stock market, the FTSE 100 index rose slightly by 0.12% to 8283 points. The French CAC40 index rose slightly by 0.52% to 7525 points. Germany DAX index rose slightly by 0.50% to 18,449 points.

In Asian stock markets, the Hang Seng Index fell slightly by 0.69% to 17,391 points. The index of state-owned enterprises fell slightly by 0.87% to 6142 points.

[China index]

Overnight, Hang Seng Technology Index futures fell by 2.08%, Nasdaq China Jinlong Index rose by 2.39%, and FTSE China A50 Index fell by 0.17%.

[China Stock Exchange]

In terms of popular Chinese stocks, Tencent Holdings (Hong Kong stocks) rose by 0.32%, Pinduoduo by 1.19%, Alibaba by 3.13%, Netease by 2.63%, Baidu by 2.00%, Ctrip by 4.14%, LI by 4.04%, Weilai by 3.77% and Xpeng Motors by 4.36%.

[foreign exchange commodities]

The picture shows the latest market as of press time.

The US dollar index fell for the fourth consecutive trading day, once breaking the 101 mark in intraday trading, hitting a new low for the year, and finally closing down 0.4% at 101.039.

Gold generally fell first and then rose, and COMEX gold closed down 0.02% to $2,550.2 per ounce. COMEX silver fluctuated higher and finally closed up 0.36% at $30.06 per ounce.

Although the decline in US EIA crude oil inventories exceeded expectations, the commodity trading consultant (CTA) tracking the trend is still intensifying the selling, and the international oil price has fallen to a six-month low. WTI crude oil fell below the 72 mark and finally closed down 1.63% to 71.98 USD/barrel; Brent crude oil finally closed down 1.46% to $76.07/barrel.

[Highlights]

Minutes of Federal Reserve Meeting: Policymakers strongly prefer to cut interest rates in September.

The Federal Reserve announced the minutes of the FOMC monetary policy meeting in July. According to the minutes, most people "think it may be appropriate to cut interest rates in September", and some people think that the labor market may deteriorate more seriously. Several Fed officials were even willing to cut interest rates immediately at the meeting on July 30-31, but the Fed Policy Committee voted unanimously to keep interest rates unchanged that month.

According to the minutes of the meeting, "Some people think that the recent progress in inflation and the rising unemployment rate provide reasonable reasons for lowering the target range of policy interest rates by 25 basis points at this meeting, or they could have supported such a decision. Most people think that if the data continues to meet expectations, it may be appropriate to relax the policy at the next meeting. "

In the United States, the number of employed people in the past year from March to March was initially revised down to 818,000, the largest revision in 15 years.

The employment growth rate in the United States in the year to March was not as strong as originally reported, which may affect the tone of Federal Reserve Chairman Powell’s speech at the annual meeting of global central banks in Jackson Hole this Friday. Some people think that he will not rule out that he will hint at a sharp interest rate cut of 50 basis points in September. Earlier, Goldman Sachs predicted that the highest revision rate could reach a record of 1 million.

Goldman Sachs predicts that Harris will win a big victory but will become the "lame duck president"

Goldman Sachs said in the research report released this week that according to the current situation, this year’s US election may have the ending of "lame duck president Harris". Goldman Sachs said that at present, at the national poll level, Harris is about 1.5 percentage points ahead of Trump and takes the lead in Pennsylvania, a key swing state. Overall, the probability of Harris winning in November is about 52%-54%. Since she took over the banner of Trump from Biden, the election has continued to rise in the past month or so. Since August 1 this year, the probability of the Republican Party winning the general election has dropped by 10 percentage points, while the probability of the Democratic Party winning the election but the Republican Party controlling the House and Senate or at least one of them has increased by 11 percentage points. Goldman Sachs also pointed out that although this is the most likely hidden situation at present, the result is still highly uncertain.

NVIDIA officially announced AI NPC’s first show in this China esports game.

On Tuesday (August 20th), NVIDIA announced in official website’s technology blog that it had released the first device-side small language model (SLM) at the 2024 Gamescom 2024, which can be used to improve the dialogue ability of game characters. NVIDIA also announced that the first game to show the technology of "NVIDIA ACE" digital human is "Mecha BREAK" developed by Amazing Seasun Games. The new technology can bring the characters in the game to life, so as to provide a more dynamic and immersive game experience.

Blue Origin, a space company owned by Bezos, suffered a setback in manufacturing new launch vehicles.

The test of Blue Origin, a space company owned by Bezos, has failed continuously in recent weeks, including a factory accident that damaged a part of the future New Glenn rocket, which is highly anticipated and is the core product of the company’s competition with SpaceX. According to people familiar with the matter, the upper part of a rocket collapsed when it was transferred to a warehouse, partly because of the staff’s mistakes.

The head of Apple App Store will resign in the reorganization.

According to informed sources, Matt Fischer, who has been in charge of Apple’s App Store business since 2010, will leave Apple in October. At present, the company is undergoing organizational adjustment to cope with the changes in global regulations. It is reported that the App Store team is divided into two teams: one is responsible for Apple’s own store and the other is responsible for the distribution of other applications. Apple executive Phil Schiller, the ultimate head of the app store, is making these changes in response to regulators forcing Apple to allow apps on the iPhone, iPad and other devices of the company to use other stores and payment methods.

SK Telecom will open an AI data center in Seoul, all supporting NVIDIA GPU.

South Korea’s largest telecom operator, SK Telecom, said on Wednesday (August 21st) that it will cooperate with American GPU cloud service company Lambda to open an artificial intelligence (AI) data center in Gangnam-gu, Seoul in December this year, which will be based on NVIDIA’s advanced graphics processor (GPU).

Gaza ceasefire talks are deadlocked.

Two Arab officials from the mediating countries and a third official involved in the negotiations revealed that the cease-fire plan in Gaza proposed by the United States last week went too far to meet Netanyahu’s demand that Israeli troops be stationed in Rafah and the Nezarim corridor. As a result, the negotiations reached a deadlock, and an Arab official lamented that unless the United States pressured Netanyahu to give up the new demands and modify the mediation plan accordingly, another high-level meeting of negotiators in Cairo later this week would be meaningless.